One of the most difficult skills for new surfers to master is staying in the “pocket”: that narrow zone on a wave where speed, control, and energy align. It’s easy to miss, especially for beginners who overwork the board or force turns instead of sitting in the sweet spot and letting the wave do the work.

The same holds true for trend following and momentum investing, especially in the aftermath of volatility spikes. After periods of turbulence, when fast reactions are rewarded, it can feel counterintuitive to sit still. But that’s exactly where the opportunity has been. Since the market dislocation in March and April, volatility has retreated, and U.S. equity indexes have trended steadily higher, carving out new all-time highs.

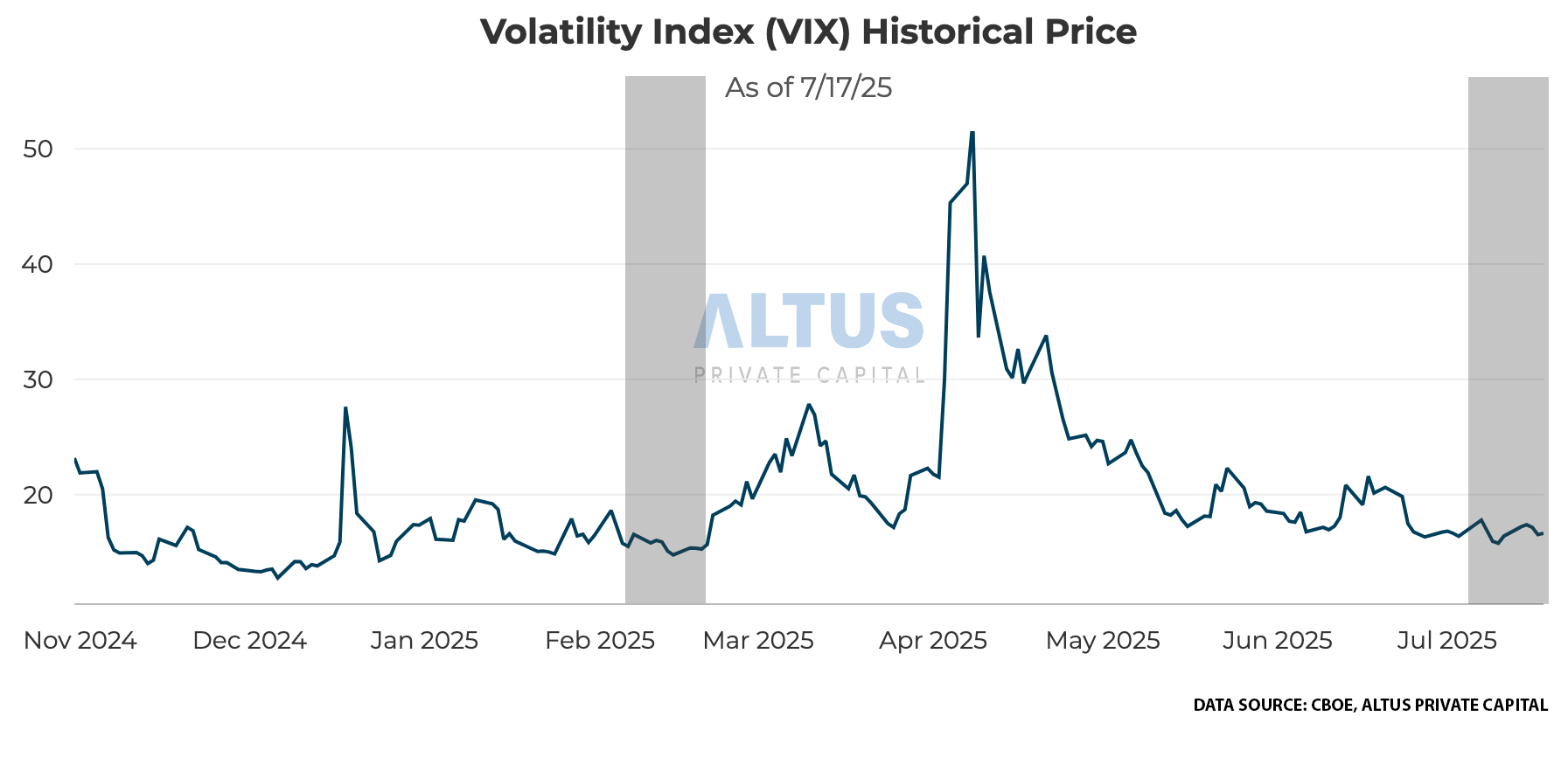

It’s an eerily familiar setup... almost identical to mid-February: calm markets, elevated sentiment, and a deeply compressed VIX. With a major July options expiration (OpEx) today and seasonality turning, we’re again seeing risks quietly build beneath the surface.

The Last Cycle

In late February, we published Positive Momentum - For Now , warning that the market’s apparent stability masked growing fragility. Risk-taking had become lopsided. Investor behavior, overconfident and under-hedged, was setting the stage.

“As we have seen time and time again… periods of low volatility inevitably set the stage for abrupt reversals. A compressed VIX can indicate rising complacency, leading to conditions where even small shocks trigger outsized reactions.”

That reversal came quickly. Just days after we published, tariff headlines hit, and the S&P 500 dropped nearly 20% over six weeks. The shift from complacency to panic was sharp and indiscriminate. Think of market volatility like a tightly coiled spring, the longer markets remain calm, the more tension builds beneath the surface, increasing the likelihood of an abrupt reversal. By mid-February, the VIX had reached unusually low levels, indicating widespread investor complacency and heightened optimism. Historical evidence and disciplined quantitative analysis have repeatedly shown that such conditions often precede sudden market disruptions. The tariff announcements simply served as the catalyst for the inevitable release of this built-up tension.

While the VIX isn’t the sole gauge of risk in our models, it does offer a valuable signal in complacent environments. Our systems track a spectrum of realized and implied volatility signals. And as we head into the low-volume weeks of late July and August, the VIX once again approaches levels that historically precede instability.

Psychology Cycles, But Discipline Endures

Fear, greed, complacency, and panic are not random anomalies. They’re recurring behavioral patterns that drive markets and opportunities. Our process isn’t based on forecasting news, but on capturing repeatable investor responses to it. By combining disciplined trend-following exposure with volatility-aware positioning, we aim to deliver equity-like returns with significantly less drawdown and correlation, especially when markets get disrupted.

Still in the Pocket — But the Wave Is Shifting

The volatility collapse over the past three months has cleared a powerful path for trend-followers. But as any seasoned surfer knows, the pocket doesn’t last forever. We’re still riding the index momentum wave, but the energy beneath the surface is beginning to shift. The buyback window is closing, earnings season is heating up, volumes are thinning, and today’s $2.7 billion OpEx adds dry tinder to a fragile structure. Layer in the historical seasonality, August is one of the most volatile months of the year and conditions appear increasingly ripe for a reversal, even if modest. It may soon be time to start paddling for the next wave.

To receive more information on ALTUS institutional SMAs and Funds, contact us here