W ith market volatility stirring as concerns surrounding inflation, Central Bank policy, & elections loom, investors might be seeking a more risk-respecting approach to equity market exposure. But what does it mean to invest in a strategy that respects risk? What are target attributes of a strategy that effectively does so? Let’s dissect one of the best in its class for managing risk in the pursuit of more consistent return: Long/Short Equity Strategies.

Addressing Key Challenges in Equity Market Investing

Long/Short equity strategies generally seek to solve three significant challenges in equity market investing: market volatility, drawdown, and inconsistency. These strategies are designed to provide a framework that respects risk without sacrificing the potential for meaningful returns. To understand their value, let’s explore the nuances of these challenges through a simple lens: the performance of the S&P 500 (SPY) across different timeframes.

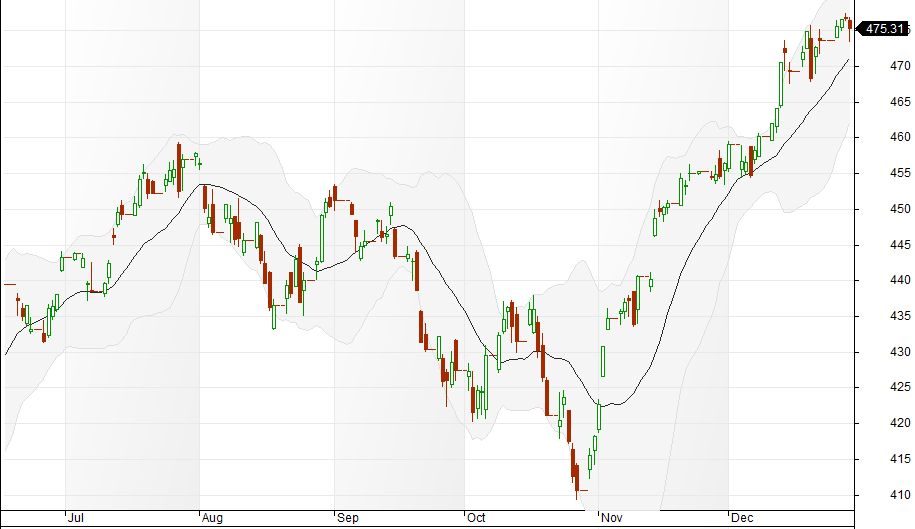

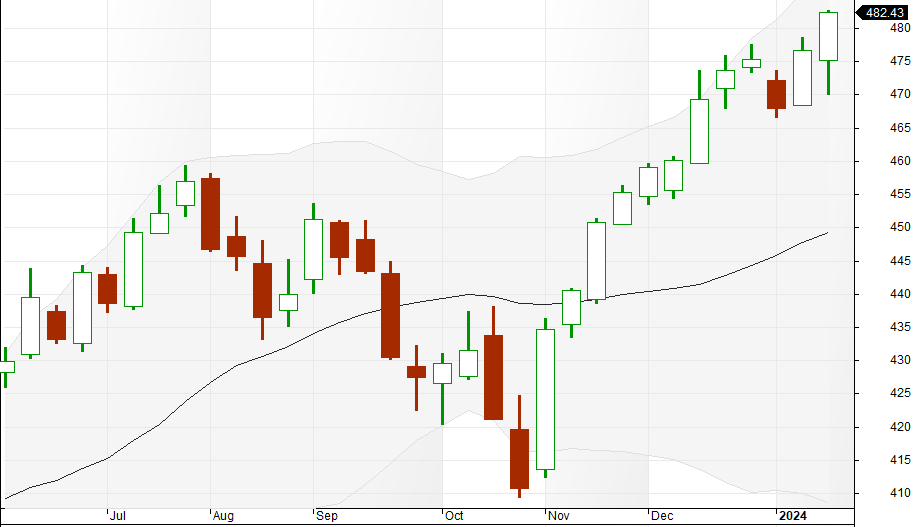

Take a quick look at the S&P 500. Here is 2024’s performance from the perspective of a few different timeframes:

Daily Chart of SPY in 2023

Weekly Chart of SPY in 2023

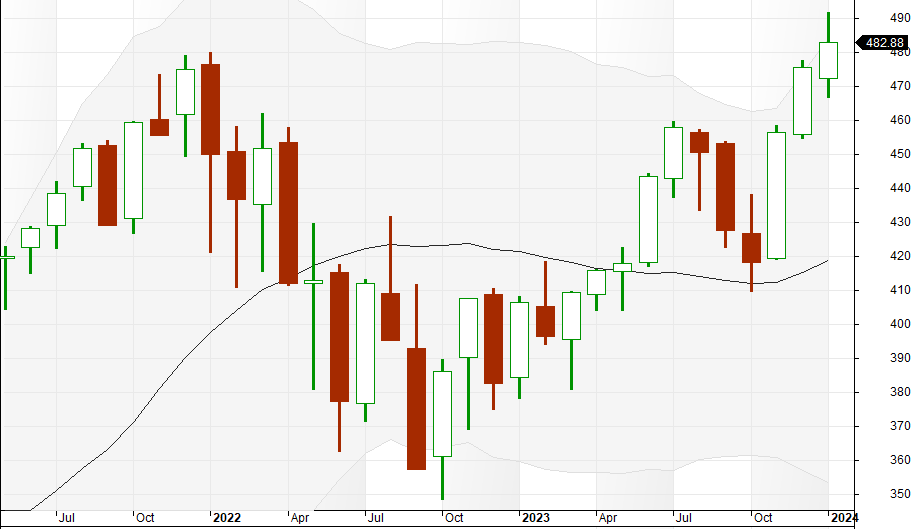

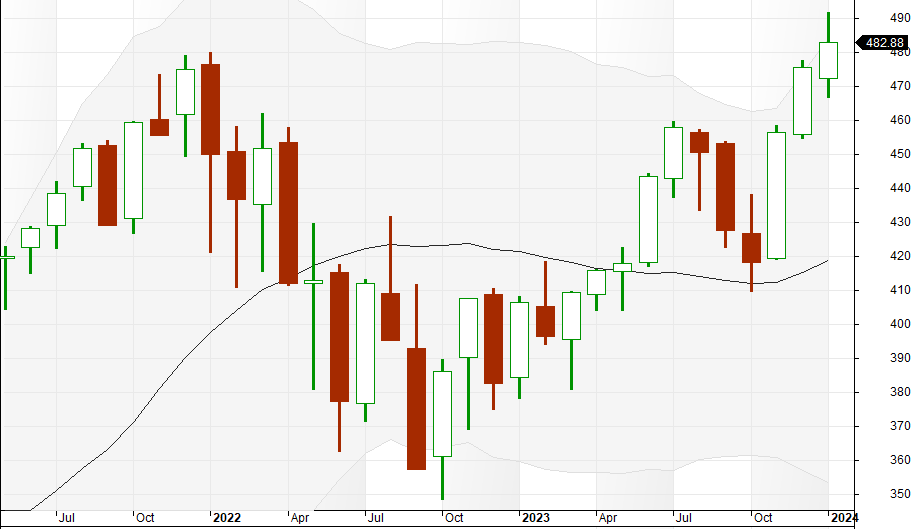

Monthly Chart of SPY in 2023

Notice how each timeframe tells a different story. In the short term, market volatility appears intense, persistent, and unavoidable. This poses a significant challenge for investors trying to manage their emotions, stay disciplined, and adhere to their investment thesis. Behavioral finance studies have consistently highlighted the impact of loss aversion—the tendency for investors to feel the pain of losses more acutely than the pleasure of equivalent gains. When volatility spikes, this psychological response can lead to irrational decisions, shaking an investor out of their thesis and jeopardizing long-term returns.

As you zoom out to larger timeframes, the picture of price direction becomes clearer, and much of the noise generated by short-term volatility seems to dissipate. From this perspective, many conclude that the answer to managing volatility is simple: time, or the "sit through it" strategy. There’s a problem with this logic. Time doesn’t always distinguish between noise (short-term market fluctuations) and real downward momentum (drawdown). Let’s consider a monthly chart of the S&P 500 in 2022:

Monthly Chart of SPY in 2022

By the end of your first month, your portfolio could be down -5.3%. By April, losses deepen to -13.7%. And by June, you’d be staring at a staggering -22% decline in your investment. At this point, we’re no longer dealing with noise. This is a significant drawdown—a sustained loss of capital that’s both excruciating to endure and detrimental to long-term wealth accumulation.

The lesson here is clear: time alone doesn’t protect against drawdowns, nor does it shield your portfolio from prolonged market downturns. In these scenarios, sitting through the pain can leave your capital locked, inaccessible, and at risk. Solving short-term volatility with time doesn't resolve the challenges you face investing, it only changes them. Then, how can we solve for both short-term volatility, and prolonged drawdown?

The logical next step seems to be hedging or maintaining very low exposure to the market. While these approaches can reduce volatility and drawdowns, this strategy results in a similar outcome, switching one challenge for another. Tethering your portfolio to lower exposure will reduce volatility and prolonged drawdown, however, at the cost of your return. This is where long/short equity strategies enter the picture. These strategies are engineered to address the dual challenge of reducing volatility and drawdowns without flattening your portfolio's return potential.

How Long/Short Equity Strategies Work

So, how does it work? Instead of remaining passively tethered to low exposure, long/short equity strategies take a dynamic approach to market conditions. Imagine being able to adjust your market exposure in response to changing environments—reducing exposure during downward momentum and increasing it during upward trends. This dynamic adjustment executed successfully would reduce drawdown and portfolio volatility while maintaining the ability to capture upside movements. However, dynamically reducing exposure alone won't solve the problem of diminished returns. To find opportunity in both bull & bear markets, long/short strategies also utilize a powerful tool: short selling. Short selling is a technique where an investor borrows shares of a stock or an index they believe will decline in value, sells those shares at the current price, and then later repurchases them at a lower price to return to the lender. The difference between the higher selling price and the lower repurchase price is the investor’s profit. By incorporating short selling, long/short strategies don’t just reduce market exposure during downturns—they also create opportunities to profit from declining markets. When the broader market declines, the profits from short positions can offset some of the losses from long positions or even turn a profit, effectively smoothing portfolio performance.

What Does the Data Say?

Altus' performances is indexed against the HFRI Long/Short Directional Hedge Fund Index (HFRIELD):

Quantitative Directional strategies employ sophisticated quantitative techniques of analyzing price data to ascertain information about future price movement and relationships between securities, select securities for purchase and sale. These can include both Factor-based and Statistical Arbitrage/Trading strategies. Factor-based investment strategies include strategies in which the investment thesis is predicated on the systematic analysis of common relationships between securities. Statistical Arbitrage/Trading strategies consist of strategies in which the investment thesis is predicated on exploiting pricing anomalies which may occur as a function of expected mean reversion inherent in security prices; high frequency techniques may be employed and trading strategies may also be employed on the basis on technical analysis or opportunistically to exploit new information the investment manager believes has not been fully, completely or accurately discounted into current security prices. Quantitative Directional Strategies typically maintain varying levels of net long or short equity market exposure over various market cycles.

Index Comparisons — B1: HFRI Fund Weighted Composite Index, B2: HFRI Fund of Funds Composite Index, B3: S&P 500 Index Total Return.

| Type | B1 | B2 | B3 | HFRIELD |

|---|---|---|---|---|

| Geo. Average Monthly | 0.35 | 0.2 | 0.86 | 0.39 |

| Std. Deviation | 1.87 | 1.54 | 4.61 | 2.92 |

| High Month | 5.86 | 3.91 | 12.82 | 8.89 |

| Low Month | -9.08 | -7.63 | -16.8 | -11.77 |

| Annualized Return | 4.29 | 2.42 | 10.88 | 4.84 |

| Annualized STD | 6.47 | 5.33 | 15.97 | 10.11 |

| Risk Free Rate | 1.15 | 1.15 | 1.15 | 1.15 |

| Sharpe Ratio | 0.5 | 0.26 | 0.66 | 0.41 |

| % of Winning Mo. | 62.56 | 64.04 | 67.49 | 62.56 |

| Max Drawdown | 20.05 | 20.11 | 46.39 | 31.38 |

Source: HFR Database

It's very apparent that Long/Short strategies are effective, they outperform the S&P 500 in volatility, and drawdown, while maintaining a marginal difference in performance. With a lower standard deviation (3.29% vs. the S&P 500’s 4.28%) and a significantly reduced maximum drawdown (-31.12% vs. -50.93%), these strategies offer smoother performance and better capital preservation. Notably, HFRIENHI achieves a strong Sharpe Ratio (0.68) compared to the S&P 500’s 0.57, demonstrating superior risk-adjusted returns. By dynamically adjusting exposure and hedging against downturns, long/short strategies provide a risk-respecting approach without sacrificing long-term growth potential.

The Bottom Line

Long/short equity strategies represent a sophisticated, risk-respecting approach to equity market exposure. By dynamically adjusting market exposure and employing tools like short selling, these strategies aim to reduce portfolio volatility and drawdowns without sacrificing return potential. They’re not about blindly sitting through the storm—they’re about navigating it with precision, discipline, and an edge. In an era of heightened market uncertainty, these strategies offer a compelling alternative for investors seeking to respect risk while staying positioned for opportunity.

While Altus uses this strategy as a broader label for understanding our process, we do not stop there. Our process combines the risk management and outperformance of Long/Short equity strategies with the liquidity, accessibility and robustness of an index fund. To learn more about the role of a long/short strategy in our process, head to the Altus Fund page.