There's a great line from 80's action movies: “It’s quiet out there, too quiet.” This sentiment pretty much sums up the current state of equity market volatility as we approach the year's end. It fees like the prevailing mood among traders is complacency, evidenced by an endless stream of analysts promoting positive seasonal charts, the Santa Claus rally and declaring that "volatility is dead".

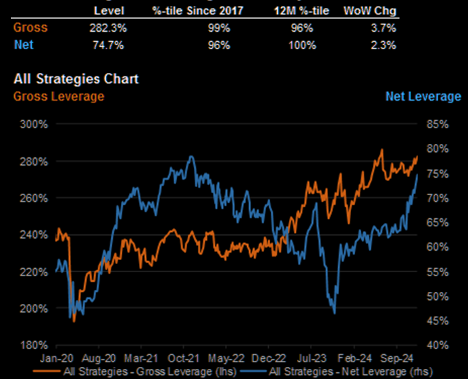

We frequently remind our investors that volatility is mean-reverting, which means it swings between extremes rather than settling in the middle. A key sign of this complacency is the current level of the Volatility Index (VIX), showcasing an unprecedented VIX call skew. Additionally, hedge funds are near record levels of leverage, which could magnify any downside should volatility return. These factors, among others, signal a potential spike in volatility.

VIX Near Complacency Levels

Source: Goldman Sachs

Hedge Fund Net Leverage Reaching Extremes

Source: JPMorgan

Hedging Exposures

To clarify, this isn't a prediction of an imminent stock market crash. Instead, it aligns with the saying, “Buy hedges when you can, not when you have to.” With multiple potential volatility triggers this week—including the FOMC meeting on Wednesday, PCE Inflation data, and Options Expiration on Friday—our short-term volatility models suggest reducing overall exposures.